The headlines moving markets from the second quarter persisted into the third: inflation, supply chain disruptions, debt ceiling debates, etc. While those headlines were seemingly negative, stocks still managed to deliver positive performance. despite a September that was the worst performance month we have seen since March 2020, though September 2020 was close. As a mid-1990s song said, “Wake me up when September ends.”

In an annual presentation to a group of pension participants, we cited the old trope, “There’s always something to worry about.” This is usually in relation to long-term equity performance overcoming the issues proffered daily by news headlines, political headwinds, etc. In 2016, we discussed Brexit and eurozone instability among other topics. Since then, stocks have performed phenomenally, despite those perceived issues. And indeed, over the last 18 months we have potentially seen the greatest leap over a headline hurdle in our lifetimes.

As always, that isn’t to say these issues and concerns aren’t important to investors, clients or even the management teams we meet with or that they don’t have a real impact on the global economy and people’s everyday lives. We have seen the significance of rising energy prices at the pump and increased grocery bills and all signs point to higher home heating bills come this winter. Pessimists will always have ammunition for why the backdrop is unfavorable for equities.

We don’t mean to belabor the inflation story as it has recently been covered in this space. While actual increases have come in higher than estimates, there is still the potential for this to be transitory. While we do not have a firm stance either way as that type of macroeconomic estimate is outside our bailiwick, it does have the potential to be beneficial to our investments.

Higher quality businesses with pricing power should be able to incorporate into prices and not be too negatively impacted. At a simplistic level, a business’s value is the sum of the present value of future cash flows. The further into the future those cash flows are expected to arrive, the greater the impact of inflation and the value of those cash flows is reduced. Our nature as a value manager is to seek out higher quality businesses with pricing power and more near-term cash flows with management teams who can utilize those cash flows to grow the business’s intrinsic value over the long term.

With respect to the other perceived headline drivers, the nuts and bolts of the supply chain and logistic headaches are far more appealing than another round of gridlock in the nation’s capital. Congress will likely raise the debt ceiling or forego that political stalemate and mint the $1 trillion coin that has been talked about before, which is to say nothing of the merits of either option. Regardless, we have seen 21 government shutdowns since 1976. Some were driven by debt ceiling debates, but only one of those was preceded by a recession over the next 12 months. On average, the S&P 500 Index has an average return of 12.5% in the following 12-month periods post-shutdown.

As investors with a long time horizon, quarterly earnings calls are not the most important aspect when we value a company. We don’t ignore them, but the long-term plans, challenges and future of a business we choose to invest in are more interesting to us. In those calls, however, whether it be automakers citing chip shortages or widget companies highlighting the number of ships stuck in ports, supply chain issues have been repeatedly cited as business headwinds.

On a more micro level, some colleagues experienced months-long delays on custom furniture orders in the fourth quarter of last year. Lest the assumption be this was due to personalized orders, another acquaintance ordered a new TV stand off the rack from a large, well-known big box retailer. The order was placed in February with an estimated May 1 delivery. After a few reschedulings, they received a note in July from the retailer telling them, “Enjoy your new TV stand. Here’s how to care for it.” Except it hadn’t arrived. Finally, in mid-August they were able to move their TV off a folding table.

Everyone has stories like this or knows someone who does. Unfortunately, most experts don’t see these issues abating before 2022. Now, the common joke is that you should have started your December holiday shopping in July.

Essential workers, truck drivers, workers at the airlines and those commanding cargo ships continued to power through the early stages of the pandemic. But with stores shut down, e-commerce necessarily exploded. Consumers already comfortable with the medium continued apace and skeptical ones had little choice other than to adjust. As Brad Pitt starring as Billy Beane in “Moneyball” said, “Adapt or die.” Consequences may not have been that harsh if one had to now purchase athleisure at home versus in a store, but the sentiment remains.

Globalization has its proponents and opponents but perhaps some unintended consequences were not anticipated or appreciated by either side. Shipping goods from one side of the globe to the other requires several logistics. It turns out that a global pandemic can throw a wrench or two in those plans. That increased demand from necessity first but perhaps convenience hasn’t seemed to wane and now we’re seeing it in the shipping logjams. In a note on the topic, HSBC reports that in the first seven months of 2021, 1.3x more goods were traded between North America and Asia when compared to pre-pandemic trade patterns.

The increase in demand has far outpaced capacity growth. As of the end of September, there were more than 40 container ships anchored outside the Long Beach/Los Angeles ports. That’s up from under 5 at the same time in 2020. Waiting times for vessels to dock has gone from less than two days to over 10.

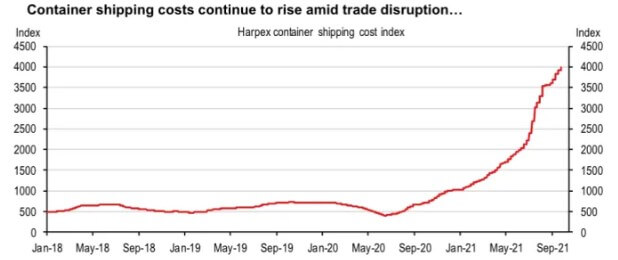

As basic economics dictates, this has driven the cost of shipping containers that much higher (exhibit above). The dollar cost to ship a container from China to the west coast of the United States is more than $20,000. That is up from just over $4,000 in January of this year and a 210% increase from as recently as May.

Ship bottlenecks and expensive shipping have impacted consumers to the downside. As an investment story, the question then becomes, “What does this all mean?” The truth is that it’s difficult to say. In an unprecedented global pandemic, unprecedented impacts follow suit.

Ultimately, the current inventory buildup could potentially aid the inflationary environment many seem concerned about. At present, manufacturers are working to build up inventories to deal with the ongoing disruption in global shipping and meet consumer demands in a more normal timeline. Eventually, demand will cool and the higher inventory build should lead to an increase in available supply and, subsequently, a decrease in overall prices.

Again, as investors who are looking at the value of a business five to seven years from now, these near-term macro headlines will add some volatility as well as intrigue. But ultimately these types of issues will correct themselves through the economic cycle. That shortsighted volatility should provide opportunity for us given our patience relative to Mr. Market and his penchant to overreact.

That said, if these backups do extend into 2022, as many experts are saying, then you might need to wait a little longer than expected for that new bedframe from Wayfair or an upgraded driver from Callaway.

As always, we thank you for entrusting us with your investment assets and your continued support. Lastly, the best compliment we can receive is a referral from a satisfied client. We appreciate your referrals and handle them with the utmost of care.

Past performance is no guarantee of future results.

The S&P 500 Total Return Index is a float-adjusted, capitalization-weighted index of 500 U.S. large-capitalization stocks representing all major industries. It is a widely recognized index of broad, U.S. equity market performance. Returns reflect the reinvestment of dividends. This index is unmanaged and investors cannot invest directly in this index.

The information, data, analyses, and opinions presented herein (including current investment themes, the portfolio managers’ research and investment process, and portfolio characteristics) are for informational purposes only and represent the investments and views of the portfolio managers and Harris Associates L.P. as of the date written and are subject to change without notice. This content is not a recommendation of or an offer to buy or sell a security and is not warranted to be correct, complete or accurate. Certain comments herein are based on current expectations and are considered “forward-looking statements”. These forward looking statements reflect assumptions and analyses made by the portfolio managers and Harris Associates L.P. based on their experience and perception of historical trends, current conditions, expected future developments, and other factors they believe are relevant. Actual future results are subject to a number of investment and other risks and may prove to be different from expectations. Readers are cautioned not to place undue reliance on the forward-looking statements.

Investing in value stocks presents the risk that value stocks may fall out of favor with investors and underperform growth stocks during given periods.

Harris Associates L.P. does not provide tax or legal advice. Please consult with a tax or legal professional prior to making any investment decisions.