A CNBC article discusses the Oakmark and Oakmark Select Funds’ long-term track records, investment philosophy and process, and portfolio construction.

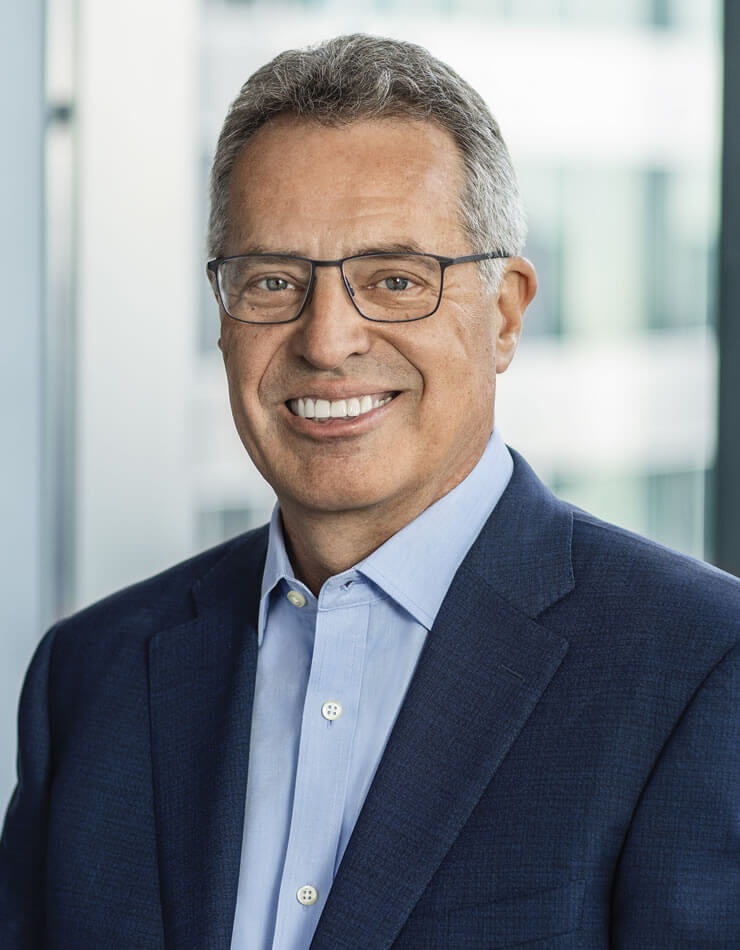

Bill Nygren Market Commentary dated June 30, 2023

Average Annual Total Returns (as of 06/30/2023):

| Fund | 3 Month | 1 Year | 3 Year | 5 Year | 10 Year | Inception |

|---|---|---|---|---|---|---|

| OAKMX | 8.64% | 27.11% | 21.67% | 11.03% | 12.05% | 12.55% |

| S&P 500 Total Return Index | 8.74% | 19.59% | 14.60% | 12.31% | 12.86% | 10.16% |

Expense Ratio: 0.89%

Fund Inception: 08/05/1991

| Fund | 3 Month | 1 Year | 3 Year | 5 Year | 10 Year | Inception |

|---|---|---|---|---|---|---|

| OAKLX | 12.41% | 22.73% | 19.81% | 7.47% | 9.28% | 11.46% |

| S&P 500 Total Return Index | 8.74% | 19.59% | 14.60% | 12.31% | 12.86% | 9.17% |

Expense Ratio: 0.98%

Fund Inception: 11/01/1996

Expense ratios are as of the Fund’s most recent prospectus dated January 28, 2023; actual expenses may vary.

Returns for periods of less than one year are not annualized.

To obtain most recent Oakmark Fund month-end performance data, view it here.

To obtain most recent Oakmark Select Fund month-end performance data, view it here.

Performance data presented represents past performance; past performance does not guarantee future results. The investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than the performance data quoted. All returns reflect the reinvestment of dividends and capital gains and the deduction of transaction costs.

The holdings mentioned comprise the following percentages of equities and equivalents as of 07/31/2023:

| Security | Oakmark Fund | Oakmark Select |

|---|---|---|

| Ally Financial | 2.3% | 3.7% |

| Alphabet Cl A | 3.7% | 8.2% |

| Bank of America | 2.2% | 0% |

| Capital One Financial | 3.2% | 6.0% |

| Charles Schwab | 2.3% | 5.5% |

| Truist Financial | 1.5% | 0% |

| Wells Fargo | 2.8% | 4.2% |

Portfolio holdings are not intended as recommendations of individual stocks and are subject to change. The Funds disclaim any obligation to advise shareholders of such changes. Information about portfolio holdings does not represent a recommendation or an endorsement to Fund shareholders or other members of the public to buy or sell any security contained in the Funds’ portfolios. Portfolio holdings are current to the date listed but are subject to change any time. There are no assurances that the securities will remain in the Funds’ portfolios after the date listed or that the securities that were previously sold may not be repurchased.

Access the full list of holdings for the Oakmark Fund here.

Access the full list of holdings for the Oakmark Select Fund here.

Morningstar rankings for the Oakmark Fund Investor Class ranked 1 our of 1,182 funds in the U.S. Fund Large Value category is as of August 21, 2023. The fund’s total return percentile rank for the specified time period is relative to all funds that have the same Morningstar category. The highest (or most favorable) percentile rank 1, and the lowest (or least favorable) percentile rank is 100. Rankings are subject to change monthly. Morningstar rankings do not include the effect of sales charges.

Morningstar rankings for the Oakmark Select Fund Investor Class ranked 1 our of 1,182 funds in the U.S. Fund Large Value category is as of August 21, 2023. The fund’s total return percentile rank for the specified time period is relative to all funds that have the same Morningstar category. The highest (or most favorable) percentile rank 1, and the lowest (or least favorable) percentile rank is 100. Rankings are subject to change monthly. Morningstar rankings do not include the effect of sales charges.

The S&P 500 Total Return Index is a float-adjusted, capitalization-weighted index of 500 U.S. large-capitalization stocks representing all major industries. It is a widely recognized index of broad, U.S. equity market performance. Returns reflect the reinvestment of dividends. This index is unmanaged and investors cannot invest directly in this index.

The price to earnings ratio (“P/E”) compares a company’s current share price to its per-share earnings. It may also be known as the “price multiple” or “earnings multiple”, and gives a general indication of how expensive or cheap a stock is. Investors should not base investment decisions on any single attribute or characteristic data point.

FCF is Free Cash Flow.

The Oakmark Fund’s portfolio tends to be invested in a relatively small number of stocks. As a result, the appreciation or depreciation of any one security held by the Fund will have a greater impact on the Fund’s net asset value than it would if the Fund invested in a larger number of securities. Although that strategy has the potential to generate attractive returns over time, it also increases the Fund’s volatility.

Because the Oakmark Select Fund is non-diversified, the performance of each holding will have a greater impact on the Fund’s total return, and may make the Fund’s returns more volatile than a more diversified fund.

Oakmark Select Fund: The stocks of medium-sized companies tend to be more volatile than those of large companies and have underperformed the stocks of small and large companies during some periods.

Investing in value stocks presents the risk that value stocks may fall out of favor with investors and underperform growth stocks during given periods.

The information, data, analyses, and opinions presented herein (including current investment themes, the portfolio managers’ research and investment process, and portfolio characteristics) are for informational purposes only and represent the investments and views of the portfolio managers and Harris Associates L.P. as of the date written and are subject to change and may change based on market and other conditions and without notice. This content is not a recommendation of or an offer to buy or sell a security and is not warranted to be correct, complete or accurate.

Certain comments herein are based on current expectations and are considered “forward-looking statements”. These forward looking statements reflect assumptions and analyses made by the portfolio managers and Harris Associates L.P. based on their experience and perception of historical trends, current conditions, expected future developments, and other factors they believe are relevant. Actual future results are subject to a number of investment and other risks and may prove to be different from expectations. Readers are cautioned not to place undue reliance on the forward-looking statements.