This is the time of year when we tend to reflect on the previous 12 months and make New Year’s resolutions. One of the most popular resolutions is to eat better and/or work out more regularly. After a difficult 2022 in the financial markets, many may attempt to get their investments into better “shape” as well. Resolutions are always well-intentioned but often fail. Why is that and what can we do to improve our odds of success?

New Year’s resolutions tend to fail when we “commit” to unsustainable or unproven actions in search of a quick outcome. Here are a few classics: “If I just followed the Atkins diet, I could lose 10 pounds in time for spring break” or “If I just bought that Peloton, I’d use it every day.” If you are under 30 years old, you can probably relate to a dusty Peloton being used as a coat rack but might be wondering, what is Atkins? That is the point. Likewise, investors may pursue unsustainable processes in search of quick returns. A year or two ago, investors may have been tempted to chase highly valued and unprofitable technology companies, “meme stocks,” or SPACs. As we saw in 2022, this strategy worked—until it didn’t.

Atomic Habits1, a book by New York Times bestselling author James Clear states, “Success is the product of daily habits—not once-in-a-lifetime transformations.” Often the right approach to achieving difficult and complex goals is to stick to the basics. The basics ought to be approachable, simple enough to follow and, if done consistently over time, drive sustainable, long-term results.

At Harris Associates, we stick to the basics of our time-tested investment process, which we have employed since the firm’s inception in 1976. As Chief Investment Officer-U.S. Bill Nygren explained in his 2021 fourth-quarter commentary, our discipline limits the risk of getting caught up in short-term trends. Instead, we position portfolios for sustainable, long-term success. We invest in businesses priced at substantial discounts to our estimate of intrinsic value, that we believe will grow per share value over time, and have management teams that think and act like owners. Our analysts are generalists who remain industry agnostic and focused on finding value, regardless of what is in favor at any given moment. We rely on intensive bottom-up, fundamental research to find ideas that meet our business and management criteria.

To further ensure our focus does not become biased by the current environment, our analysts must defend recommendations against a committee of our seasoned investment professionals before it becomes eligible for investment. We then construct portfolios based on each company’s degree of undervaluation and our conviction in our estimate of value. Being grounded by intrinsic value, which is defined as the present value of future cash flow, gives us the freedom to ignore near-term noise. Over the long term, a company’s share price will ultimately reflect its fundamental performance.

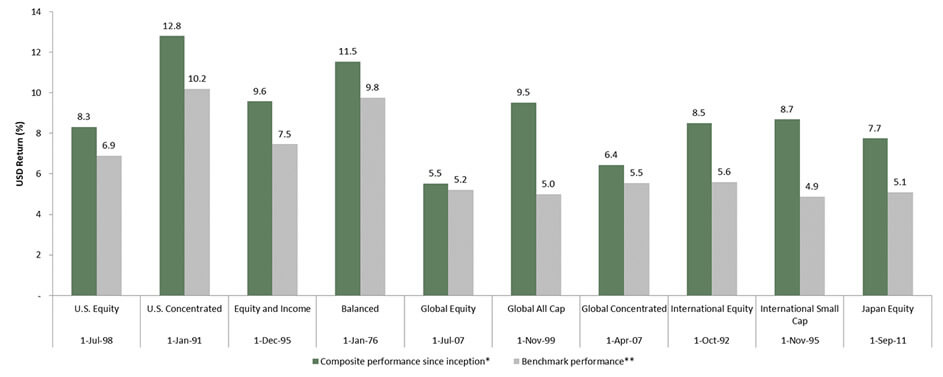

We believe our historical track record speaks to the merit of adhering to these core principles across products throughout our 47-year history.

*Inception dates are listed below each composite name.

** Benchmarks: Russell 1000 Value Index for US Equity; S&P 500 Index for Concentrated; Blended Balanced for Equity and Income and Balanced; MSCI World Index for Global All Cap, Global and Global Concentrated; MSCI World ex-US Index for International and International Small Cap and MSCI Japan Index for Japan Equity.

Data as of December 31, 2022.

At Harris Associates, we know a long-term focus is key to success. Our goal when managing client assets has always been to provide capital appreciation and protection. We set out to achieve this goal by sticking to our consistent investment process for a long period of time. We hope 2023 proves to be a prosperous year in all your endeavors, and whether it relates to fitness, finance or any goal, we invite you to join us in sticking to the basics.

1Clear, James. Atomic Habits. New York, Avery Publishing, 2018.

The information, data, analyses, and opinions presented herein (including current investment themes, the portfolio managers’ research and investment process, and portfolio characteristics) are for informational purposes only and represent the investments and views of the portfolio managers and Harris Associates L.P. as of the date written and are subject to change and may change based on market and other conditions and without notice.

Certain comments herein are based on current expectations and are considered “forward-looking statements”. These forward looking statements reflect assumptions and analyses made by the portfolio managers and Harris Associates L.P. based on their experience and perception of historical trends, current conditions, expected future developments, and other factors they believe are relevant. Actual future results are subject to a number of investment and other risks and may prove to be different from expectations. Readers are cautioned not to place undue reliance on the forward-looking statements.

Statements concerning financial market trends or other investment strategies are based on current market conditions, which will fluctuate. There is no guarantee that these investment strategies will work under all market conditions or are appropriate for all investors. Each investor should evaluate their ability to invest for the long term, especially during periods of downturn in the market. Market outlook and investment strategies are subject to change without notice.

Jack Morgan

Client Communications Specialist