At the start of 2023, the bullish and the bearish investor each had reasonable cases for what this year should bring in the equity markets. The optimists would point to low valuations after a tough 2022. Sure, the fourth quarter was strong, but certain areas had an incredibly rough December, especially Big Tech as portfolio managers looked to harvest losses. The pessimists would point to the continued overhang of a litany of issues facing both the global and domestic economies: rates, inflation, war, etc.

At Harris Associates, we are always thinking through the economic cycle: looking at a five- to seven-year time horizon and trying to normalize what a company’s earnings streams will look like. So, while we think less about one-year chunks (primarily as dictated by the calendar), it is interesting to look back on history and see what historical performance has looked like when coming out of tough performance years; both relatively and absolutely.

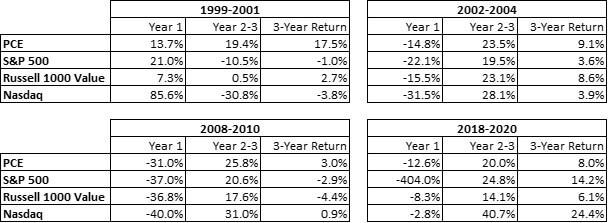

The first column shows the “difficult” calendar stretch for equities using our Private Client Equity (PCE) composite against three indexes: S&P 500, Russell 1000 Value and the Nasdaq. Column two indicates the subsequent two years’ annualized performance and the last column puts them all together for a three-year annualized performance figure.

Obviously, it is necessary to caveat that past is not always prologue and prior performance is no guarantee of future results. However, it is an interesting data set to look at, assess and ask “why?” As our clients know, we run concentrated portfolios, generally holding 20 to 25 stocks. Our belief is that our research process, concentrated portfolios and investment time horizon focus are what best position our portfolios for long-term success.

In addition, the stock market can be overly pessimistic in tough market periods and unduly punish names despite solid underlying fundamentals, thus throwing the baby out with the bath water. As an active manager, we have the ability to move names in and out of the portfolio when these types of events occur. That agility in the wake of tough market conditions should position client portfolios to take advantage of an eventual recovery.

A good example of this is Alphabet. In its most recent earnings update, the company reported a three-year compound annual growth rate of 18.5% in its core search business. Given the size and scale of that business, we believe that’s pretty good! But one look at a 2022 stock chart for that company and you would not think that.

So, while the bulls and bears could have gone back and forth before the open on January 2, how have we started? The equity markets continued the fourth quarter’s positive momentum as the S&P 500 added 7.5% in the first three months of 2023. After a rocky first nine months of last year, the continued resilience was much welcomed, even as the market continues to digest a bevy of macroeconomic variables.

March of this year also marked the three-year anniversary from the market bottom amidst the burgeoning COVID-19 pandemic. Since that point, the S&P 500 has returned almost 67%. Given the volume of historic events we have endured, that number is impressive.

Since March of 2020, market participants have dealt with as much or more than some investors deal with in a generation. The list is well known, but still is worth recalling. The largest pandemic in a century; $4 trillion in pandemic-induced stimulus; interest rates bottoming overnight only to be followed by the quickest pace rate hikes ever; inflation levels not seen in four decades; the ongoing conflict in Eastern Europe; oil bottoming to negative levels overnight followed by reaching $100+/barrel; a scorching hot housing market; and the second and third largest bank collapses in U.S. history.

It’s worth diving into the last item being as it’s the most recent occurrence and what hurt stocks the most in the quarter. At Harris Associates, we have long been positive on financial stocks, especially the big banks. From our perspective, these are above-average banks that are trading at mid- to high-single digits of their earnings, with solid management teams and, especially in the wake of the Silicon Valley Bank collapse, continuing to grow their deposit base.

We believe that Silicon Valley bank collapsed because its client base was highly concentrated, both in where the deposits were coming from and how many deposits were with a few clients (their top 10 clients had $13.3B of their deposits). Additionally, they had a mismatch in their assets and liabilities: the latter were short-term and benefitting from rising rates and the former were long-term and being hurt by rising rates. So, when their client base decided to move in lock stop and take out their deposits, the firm’s mismatch led to their downfall.

With larger more diversified banks and many regional banks, you do not have similar types of issues. They may have a similar mismatch in duration but not to the same extent given their more robust lending operations.

This also isn’t the toxic asset issue that caused the banking contagion in 2008. JPMorgan CEO Jamie Dimon wrote in his recent annual letter that “recent events are nothing like what occurred in the 2008 global financial crisis,” noting the $1T in consumer mortgages that were about to go bad, and the excess leverage taken on by these institutions.

We would agree with that assessment. Since the prior crisis, these institutions undergo rigorous stress tests and proved resiliency through the pandemic. In times of crisis like this, it’s important to be nimble in research analysis as well. Our first move is to assess all our current holdings for potential risks and speak to as many management teams as possible. Silicon Valley Bank failed on a Friday and by midday Monday, we had done that initial assessment and further and deeper dives have followed since. We also want to look for new opportunities and we are excited about the ideas we are seeing. It is important to be reactive but not overreact.

While the momentum of January did not carry through the entire quarter, the March reaction to Silicon Valley Bank unduly punished an entire sector and we think that should be an opportunity for long-term value seekers.

As always, we thank you for entrusting us with your investment assets and continued support. Lastly, the best compliment we can receive is a referral from a satisfied client. We appreciate your referrals and handle them with the utmost of care.

Past performance is no guarantee of future results. Current performance may be lower or higher than the performance data quoted. All returns reflect the reinvestment of dividends and capital gains and the deduction of transaction costs.

The specific securities identified and described in this report do not represent all the securities purchased, sold, or recommended to advisory clients. There is no assurance that any securities discussed herein will remain in an account’s portfolio at the time one receives this report or that securities sold have not been repurchased. It should not be assumed that any of the securities, transactions, or holdings discussed herein were or will prove to be profitable.

The S&P 500 Total Return Index is a float-adjusted, capitalization-weighted index of 500 U.S. large-capitalization stocks representing all major industries. It is a widely recognized index of broad, U.S. equity market performance. Returns reflect the reinvestment of dividends. This index is unmanaged and investors cannot invest directly in this index.

The Russell 1000® Value Index measures the performance of the large-cap value segment of the U.S. equity universe. It includes those Russell 1000® companies with lower price-to-book ratios and lower expected growth values. This index is unmanaged and investors cannot invest directly in this index.

The NASDAQ Composite Index is a broad-based market-capitalization weighted index of all common type stocks on the NASDAQ Stock Market, including common stocks, American depositary receipts, ordinary shares, shares of beneficial interest or limited partnership interests, and tracking stocks. The index includes all NASDAQ listed stocks that are not derivatives, preferred shares, funds, exchange-traded funds (ETFs) or debentures. The index used total return values beginning 10/31/2003, price return values were used prior to this date. The total return index values for the NASDAQ Composite Index were synchronized to the value of original corresponding indexes at the close on September 24, 2003. This index is unmanaged and investors cannot invest directly in this index..

The information, data, analyses, and opinions presented herein (including current investment themes, the portfolio managers’ research and investment process, and portfolio characteristics) are for informational purposes only and represent the investments and views of the portfolio managers and Harris Associates L.P. as of the date written and are subject to change without notice. This content is not a recommendation of or an offer to buy or sell a security and is not warranted to be correct, complete or accurate.

Investing in value stocks presents the risk that value stocks may fall out of favor with investors and underperform growth stocks during given periods.

Harris Associates L.P. does not provide tax or legal advice. Please consult with a tax or legal professional prior to making any investment decisions.